In 1983, PNC was formed from a merger between Pittsburgh National Corporation and Provident National Corporation based in Philadelphia, forming the largest bank in Pennsylvania. So if you’re not eligible for the PNC High Yield Savings accounts, there are much better savings account choices to help maximize your interest earnings.

However, this Standard Savings interest rate falls far short of other banks like Capital One or Marcus Goldman Sachs. PNC Standard Savings interest rates are comparable to large national banks like Chase, Bank of America and U.S. If you live in one of the ten states where PNC issues High Yield Savings accounts, PNC Bank savings rates are among the highest available. If you have a PNC High Yield Savings account, you could earn $40 in the first year on a balance of only $1,000. If you qualify for a relationship rate, you could earn up to $1.50 in the first year.

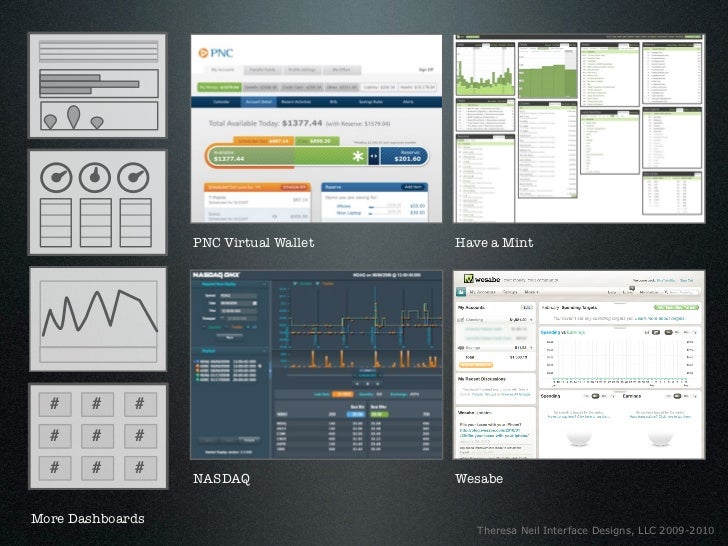

On a balance of $5,000, you’ll earn $0.50 in the first year with the standard interest rate. With a Standard Savings account, your earnings will be negligible. How Much Can You Earn With PNC Savings Account The standard rate for all Virtual Wallets is APY, but customers who qualify for a relationship rate by meeting a monthly transaction or direct deposit requirement can earn 0.02% to 1.25% APY. You can choose between four Virtual Wallet account options, including one designed for students. PNC Bank also offers the that combines a checking and savings account.

PNC offers 2.00% APY on a 13-month fixed-rate CD, but does require a minimum opening balance of $1,000. If you don’t need to regularly access your savings and don’t qualify for the PNC High Yield Savings account, a PNC Fixed Certificates of Deposit is your best option. However, depending on location and additional PNC accounts, you may only earn between 1.00% and 1.75% on your balance, which is not particularly competitive. Money Market accounts are designed to offer higher interest rates for larger balances. While not traditional savings accounts, PNC Bank also offers money market accounts and certificates of deposit (CDs). Otherwise, you’ll need to open an account at a local branch. You can apply online if the applicant is 17 or under and the custodian on the account is over 21. The interactive online banking experience allows kids to visually deposit and allocate funds to spend, save and share accounts.Īccounts require no minimum deposit to open and charge no monthly fees for account holders under 18. This savings account is designed for children and offers Sesame Street-themed financial literacy training. Applicants must be at least 18 years old and a resident of a qualifying state. This savings account has no minimum deposit requirement and charges no monthly fees.Īccounts can only be opened online. If you live in one of these states, you qualify for a PNC savings account rate that’s competitive with the best high-yield savings accounts. PNC High Yield Savingsīy far, the best PNC savings accounts are the High Yield Savings, but these accounts are only available to residents in select states. Younger customers can open an account in person at a local branch. You must be 18 or over to open an account online. Account holders under 18 also qualify for a fee waiver. To avoid this fee, you can maintain an average $300 monthly balance, link a PNC checking account or schedule recurring $25 deposits from your PNC checking to your savings account. There is no minimum deposit to open the account, and it charges a $5 monthly service fee. PNC’s Standard Savings account is typical for a large national bank. There are a variety of savings accounts to choose from at PNC Bank. PNC Bank also provides bank cards at no charge allowing you to deposit or access your savings funds at ATMs nationwide. Your savings account must have a minimum of $1 balance to earn interest. All savings accounts are limited to six withdrawals per billing statement, and additional withdrawals will result in a fee. All PNC savings accounts are insured to the maximum amount permitted by law.

0 kommentar(er)

0 kommentar(er)